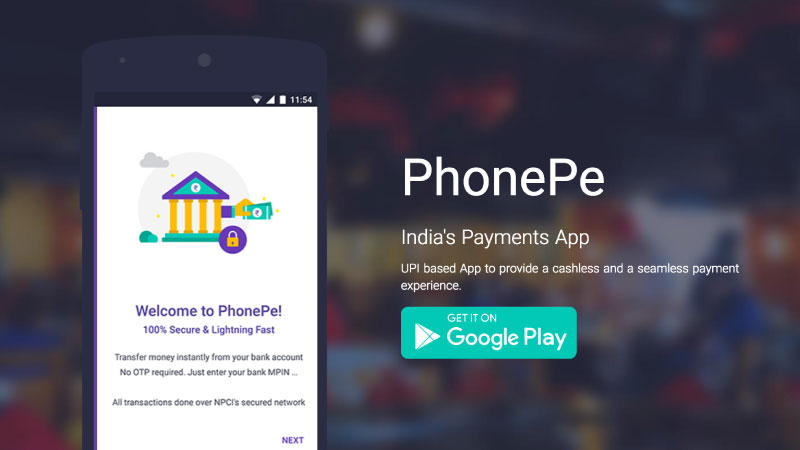

Demonetization blues? ATM queues? Kiss them goodbye and say hello to PhonePe, Flipkart’s mobile payments app based on the government-backed Unified Payment Interface (UPI) platform. It’s cool, convenient and hassle-free. And, even better, it’s free!

If you haven’t heard of PhonePe, here’s what you are missing. With the demonetization of ₹500 and ₹1,000 currency notes on November 8 and the long queues to draw cash from ATMs, are you wondering how to brace for the cash crunch? Luckily for you, there’s hope beyond cash. In fact, a cashless digital payments economy is the future. And PhonePe from Flipkart is at the forefront of this revolutionary change.

To help fulfill your wishes at various times, Flipkart offers multiple payment methods including card-on-delivery, internet banking, or payment by credit and debit cards. To further simplify online payments, Flipkart’s latest offering is the PhonePe wallet app. Launched in partnership with YES Bank, PhonePe allows you to link bank accounts securely to your smartphone through the encrypted software of the National Payments Corporation of India.

How to use PhonePe

Download the app from the Google Play Store and use it as an online wallet to handle all your monetary transactions. PhonePe has replaced Flipkart Money and Myntra Cashback, which means all customer refunds on Flipkart and Myntra are currently processed using PhonePe.

Here are the top 7 things you should know about PhonePe:

1. PhonePe is among India’s first UPI apps

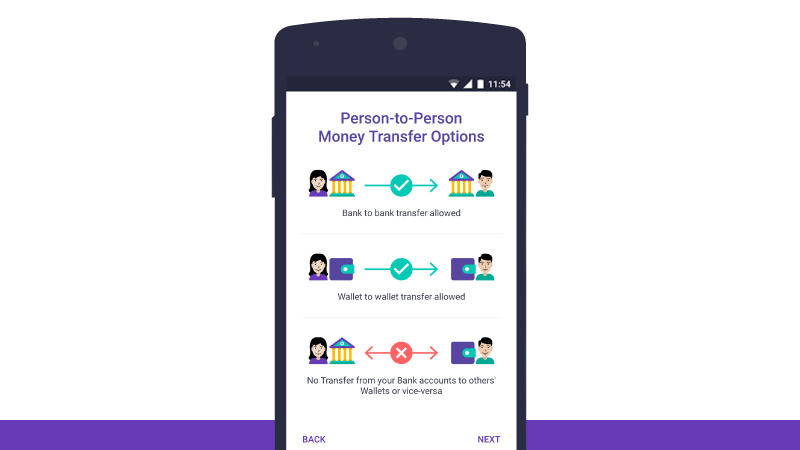

PhonePe is based on the government-backed Unified Payment Interface (UPI) platform. What is UPI? UPI is built over the IMPS (Immediate Payment Service) infrastructure and allows you to transfer money between any two parties’ bank accounts by using unique identifiers like mobile number or VPA (a unique payment address) without using account numbers or IFSC codes. This makes it easy to send or receive money. Just enter a receiver’s mobile number/VPA and send him/her money instantly into his/her bank account!

2. No need to exchange bank account details

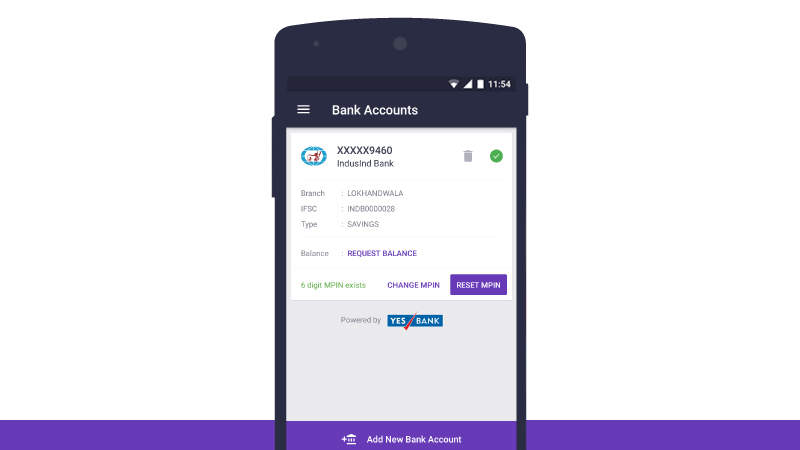

Around 30 major banks are live on the UPI platform, including banks with large networks such as State Bank of India, HDFC Bank, ICICI Bank, Standard Chartered Bank, and more. When you link your bank account to your PhonePe app, all you need to do is share (and verify) your mobile number and bank name, and UPI will retrieve the account details from your bank over a secure network. If your bank account is not live with UPI, you cannot add your bank account to the PhonePe app. However, you can receive refunds from Flipkart/Myntra into your PhonePe wallet.

3. Say goodbye to multiple authentication methods

Through PhonePe UPI app, you can send and receive money instantly using a VPA (or Virtual Payment Address). This means you can also transfer money between any two bank accounts. You can also pay directly from your bank account to both online and offline merchants. The best part: You don’t need to enter credit or debit card details, a one-time password, your bank’s IFSC code or any other details.

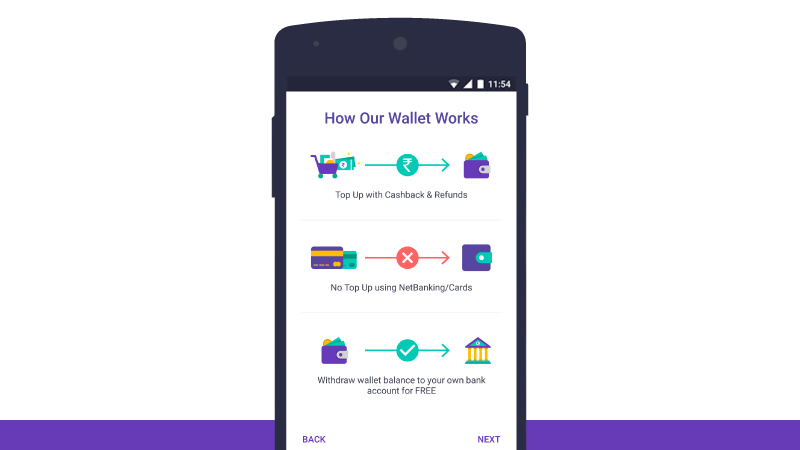

4. Don’t bother topping up your wallet

The other thing that you’ll love about the PhonePe app? You don’t have to load funds into your wallet. Rather, you can make payments from your bank account by using just your mobile number (the same one that’s registered with your bank) or a virtual ID. This means you no longer have to worry about running out of wallet balance or going through the whole process of topping up your wallet before your transaction.

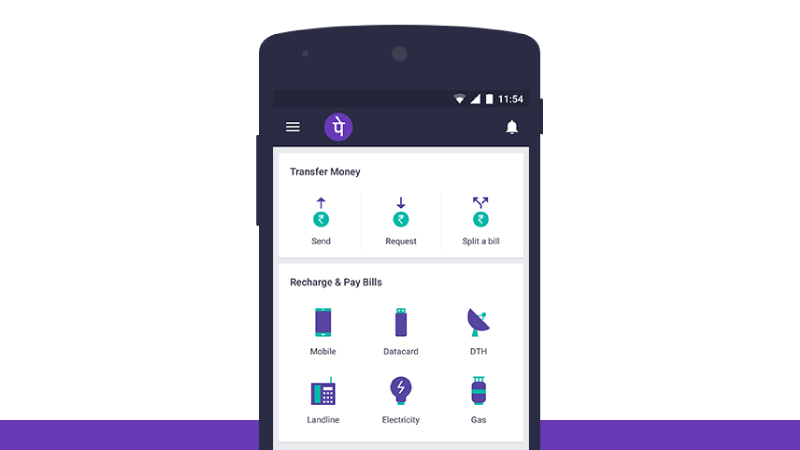

5. Bill payments, recharges and money transfers made easy

Use your PhonePe app to pay your postpaid and utility bills as well as recharge your prepaid mobile number, data card and DTH. Send or request money from loved ones by entering their number, name or VPA. Want to split the popcorn bill with your friends after watching a movie? With the PhonePe app, you can do that too! You can also check your bank account balance or scan QR codes to pay.

6. Safe, secure and free

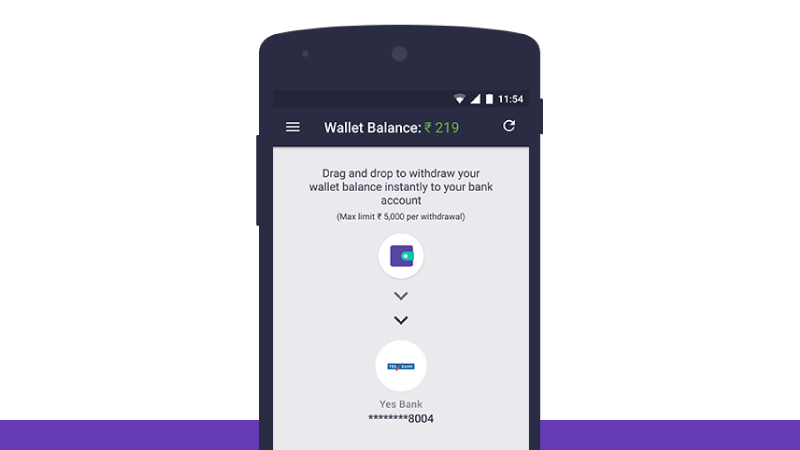

The PhonePe app allows you to make transactions free of cost. Now you can exchange or return your order to Flipkart and receive the refund in your PhonePe wallet. You can even withdraw this wallet balance instantly into your bank account at no extra charge.

PhonePe is 100% safe and secure. It is powered by Yes Bank. All payments happen over secure banking networks and the app does not store any user data or passwords. All you need to do for every transaction is enter your MPIN (which only you know). For security purposes, never share your MPIN with anyone.

7. Easy limits and validity

Have transaction limits ever bogged you down? Those days are long gone. With PhonePe, you can easily make big transactions. You are allowed you to spend a maximum of ₹1 lakh per transaction. That’s both generous and convenient. In addition, you can enjoy long validity of your wallet balance. If you transact at least once in two years, be assured that your PhonePe wallet will be active, and the balance will not expire.

How to get started

- PhonePe is currently available for Android and iOS users. Android users, please download the app from the Google Play Store and install it on your device. iOS users can sign up for a private beta here

- Open the app and verify your mobile number (your registered mobile number should be the same as the one registered with your bank account)

- Enter your name, email address and set your 4-digit password and activate your wallet

- In the next step, click on ‘Create New VPA’

- Link your bank account to the app by selecting your bank, and the app will automatically fetch the details

- Confirm your bank details, and start using the app to send or receive money or transact online with ease

From 500 thousand to 1 Million fans in 7 days! #UPIRocks @UPI_NPCI @NandanNilekani @_sachinbansal @binnybansal @YESBANK pic.twitter.com/ne7n0BnTzl

— PhonePe (@PhonePe_) December 1, 2016

Flipkart’s PhonePe app has been downloaded 5 lakh times already from the Google Play Store. If you haven’t got around to downloading it yet, then do it right away! You can also get up to Rs 100 off* on your first UPI transaction!

Be sure to share your experience with us in a comment.

*Terms and conditions apply